Proliferation of Pump & Dump Schemes - Shield

Market control plans alluded to as 'pump and dump' are not new. Truth be told, concerns were being brought up in the US Senate as soon as the 1930s, however what's happening are a portion of the manners by which these false plans are currently being run. Yet, before we dive into the subtleties, we should return to rudiments… .

What is a 'Pump and Dump' plot?

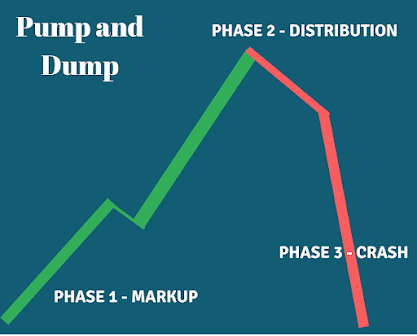

'Pump and dump' (additionally alluded to as 'slope and dump') plots basically have two sections.

First and foremost, the culprits organize a mission to blow up ('pump') the cost of a stock with bogus or deluding data.

Furthermore, when the cost has been misleadingly expanded, the culprits sell their own property ('dump') harvesting the benefits. Obviously, different financial backers eventually become presented to a drop in the market cost because of the deal action. What's more, when the fraudsters stop their market control crusades, the leftover financial backers are left with unsellable, modest stock with no interest from new purchasers.

How enormous is the issue?

The short response is that this is a worldwide issue.

Pump and dump plans have multiplied in the day exchanging blast we've seen during the COVID-19 pandemic. Indeed, in September 2020, the Hong Kong Securities and Futures Commission (SFC), assessed that 20% of the market control cases it was researching were pump and dump plans. Alerts have been given by everybody going from the US Federal Bureau of Investigation to the UK's Financial Conduct Authority.

It's maybe little marvel that an ever increasing number of individuals have succumbed to this kind of misrepresentation during the pandemic when so many have lost their positions, or to be perfectly honest, essentially experienced outrageous weariness in what felt like unlimited lockdowns. Many have been enticed to take advantage of 'lucky breaks' elevated to them similar to a simple method for bringing in cash. Add to this the substantial feeling of dread toward passing up a major opportunity when companions, or without a doubt powerhouses, are clearly creating gains through exchanging action (regardless of whether stock or crypto) and it's an amazing coincidence.

In any case, there's another component that is concerning controllers and that will be that these plans are progressively being worked through web-based media stages - Facebook, Instagram, WeChat, Whatsapp, Telegram - and surprisingly web based dating stages.

Who do you go to for speculation guidance?

Web-based media stages are, obviously, the ideal vehicle for the successful and designated scattering of bogus and deceiving data asking adherents to purchase a specific stock or crypto resource. They are likewise, and progressively, the scenes for individuals to get to bits of knowledge and conclusions over traditional press and other confided in sources. In a universe of 'counterfeit news,' doing investigate on an open door promising speedy and simple returns, is more basic than any other time in recent memory.

The ascent of powerhouses effectively advancing 'venture' amazing open doors is likewise concerning controllers. At the point when the CEO of the UK FCA name-dropped Justin Bieber, J Lo, and the Kardashians in his September 2021 discourse, you know there's an issue. In the expressions of Phineas T. Barnum, the nineteenth century American entertainer 'there's no such thing as awful exposure,' however I question that getting a fair notice in a discourse by the FCA was in the advertising plans of those big names!

In any case, it's not only the true blue forces to be reckoned with that individuals should be worried about. A few plans are utilizing other refined strategies including mimicking notable venture counselors and market analysts to draw casualties into their plans. Culprits regularly likewise offer inside data or speculation tips to their adherents to additional captivate them to exchange.

Are culprits being arraigned?

Indeed, there are various cases as of now in the courts. Here are subtleties of only two:

- In the principal case, the culprit, utilizing the assumed name "Alex DeLarge," utilized a Twitter record to elevate specific stocks and to spread bogus and misdirecting data to support his more than 70,000 devotees to purchase specific stocks. The respondent got more than $1 million in benefits through the plan.

- In the subsequent case, a Florida man supposedly cheated financial backers out of more than $19 million north of a 7-year time span by means of the utilization of deceitful official statements, false protections exposures documented with the U.S. Protections and Exchange Commission, just as manipulative stock exchanging. Whenever indicted, the litigant faces a $12.5 million fine and a most extreme conceivable sentence of 245 years detainment. Indeed, you read that accurately, 245 years!

What moves should firms make?

Right off the bat, firms ought to be effectively recognizing gatherings of customers who exchange a similar stock, in a similar bearing, and around a similar time. These customers might have opened records at a comparable time or have a similar record contact subtleties.

Furthermore, and to help the main activity, firms ought to have set up, or ought to execute, innovations and mastery to associate 'Know Your Customer' data with reconnaissance and market information, close by expected exchanging practices and customer credit cutoff points to empower successful examinations, and At long last, firms should record Suspicious Activity Reports (SAR)/Suspicious Transactions and Order Reports (STORs) and particularly where there is an unexpected and unexplained value development.

Are alerts and the danger of implementation activity enough?

We've effectively talked about a portion of the moves that controllers are making - from giving alerts through to authorization. Furthermore, continuous observing of market movement empowers controllers to investigate exchanging designs, decide organizations of associated parties and to discover the subtleties of fundamental customers engaged with the organizations of concern.

In any case, of the horde of activities in progress to handle pump and dump conspires, my undisputed top choice is the original methodology took on by the Australian Securities and Investments Commission. In a striking move, ASIC is penetrating talk bunches worked on informing applications to connect straightforwardly with - and upset - individuals engaged with pump and dump action. Talk about taking the battle against market control to the cutting edges!

Emma Parry

Originator and CEO

NovaFin Consulting Ltd

NovaFin gives direct danger and culture warning administrations to firms all through the monetary administrations biological system.

Comments

Post a Comment